Handling accounts payable for leading hospitality establishments required a tech-driven solution to speed up and streamline our payment processes, reducing the need for time-intensive manual reconciliations of client bank accounts and payments.

The challenge: Incomplete solutions

Before discovering Apron, Prysm explored several traditional wallet-based applications like Modulr. However, these tools only addressed a fraction of their problems, primarily focusing on fund transfers into bank accounts for payments.

These solutions also didn’t solve for Bhimal’s other major challenges:

Lack of integration: Despite trying different embedded payments software, Bhimal found that integration with other parts of his workflow were still lacking. He was still having to lift payment details manually, send remittances manually, and reconcile payments manually.

Risk of fraud: Prysm manages millions of pounds of client funds each month. The solutions Bhimal had been using were inherently more prone to errors and risk.

Prysm needed a comprehensive solution that covered a broader range of issues in the accounts payable workflow.

Discovering Apron

Apron came to Bhimal’s attention through a client referral. Recognising the need for an all-in-one tool to address their pain points in accounts payable, Prysm found that Apron aligned with their specific requirements — namely a need for better efficiency and greater security.

Why Apron stood out

Bhimal chose Apron because we provided solutions to multiple pain points in the accounts payable workflow, integrating seamlessly with Prysm’s accounting software, Xero.

Apron offers full transparency throughout the payments process, making it easier for Bhimal to manage payments and invoices. Additionally, according to Bhimal, Apron’s “user-friendliness and scalability” were vital factors in the decision-making process.

What’s changed since switching to Apron

After implementing Apron, Prysm experienced significant improvements in their financial operations and payments as a service offering:

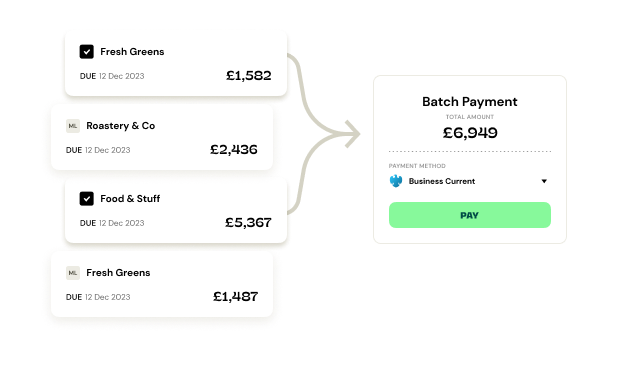

Time savings and automation: Prysm previously had to manually prepare payment runs for clients and load them into bank accounts, a process that posed security and risk challenges. Apron automated remittances and invoice-to-payment reconciliation in Xero, resulting in streamlined bookkeeping and substantial time savings.

Risk reduction: Managing over £2 million in payments per month came with inherent risks, such as invoice fraud and bank fraud. Apron’s account number matching feature enhanced payment security by ensuring funds were confidently routed to the correct bank accounts.

Scalability and uniform processes: Apron provided Prysm with an approach that could be uniformly applied across all clients. This standardisation facilitated effortless scaling of services without the need to adjust processes for individual client preferences.

Taking the pain out of supplier payments

“Apron takes the pain out of supplier payments. There’s a reduction in risk, a reduction of man hours, and an increase in efficiency.”

Results so far

Prysm has seen the following since implementing Apron:

- Volume of payments processed: Over £2 million in payments per month, including supplier and payroll payments.

- Security and fraud prevention: Enhanced security with account number matching to prevent invoice and bank fraud.

- Efficiency in Reconciliation: Automation of remittances and invoice reconciliation in Xero, reducing bookkeeping time.